AIA Group Hospitalization and Surgical: Comprehensive Coverage and Benefits

Health is wealth, and in today’s uncertain times, having comprehensive health Takaful is more crucial than ever. AIA Group Hospitalization and Surgical plans offer a wide array of benefits, providing individuals and businesses with the peace of mind they need when facing medical challenges. In this article, we will explore the key features and advantages of AIA Group Hospitalization and Surgical plans, addressing common questions and shedding light on the coverage they provide.

In this article, we will explore AIA Group Hospitalization and Surgical, answering key questions and shedding light on the coverage and benefits they provide.

Understanding Surgery Coverage with AIA

One of the primary concerns individuals have when considering health Takaful is whether it covers surgical procedures. With AIA Group Hospitalization and Surgical plans, policyholders can rest assured that surgical treatments are included in the coverage. Whether it’s a minor procedure or a major surgery, AIA’s plans are designed to provide financial support and assistance during hospitalization for surgical treatments.

AIA Group Hospitalization and Surgical Package

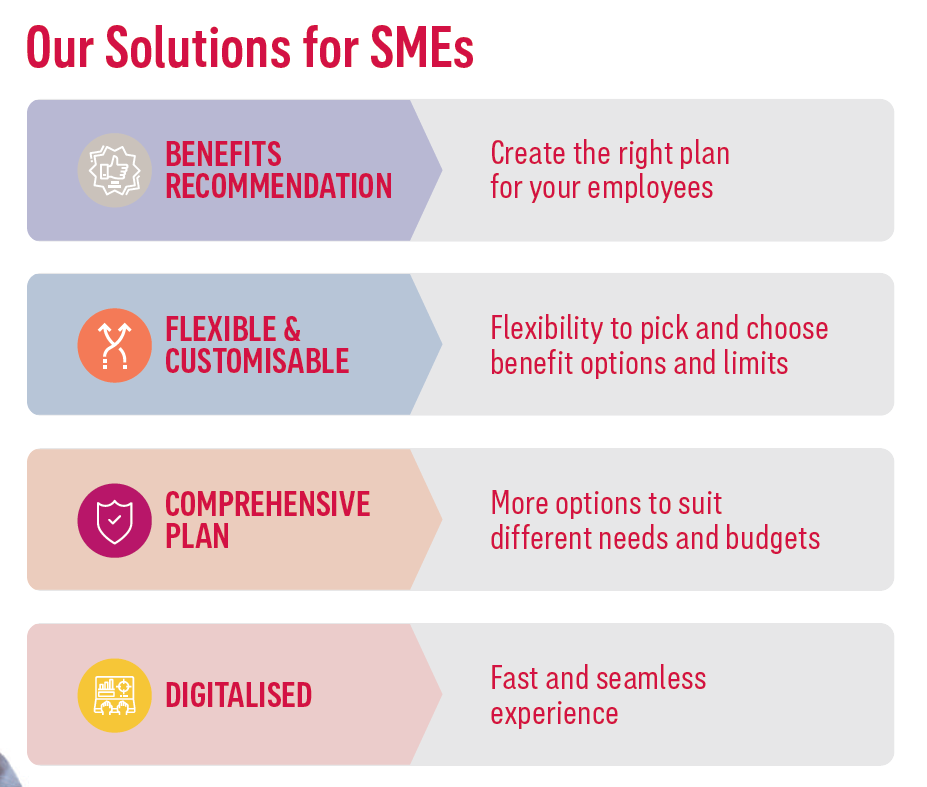

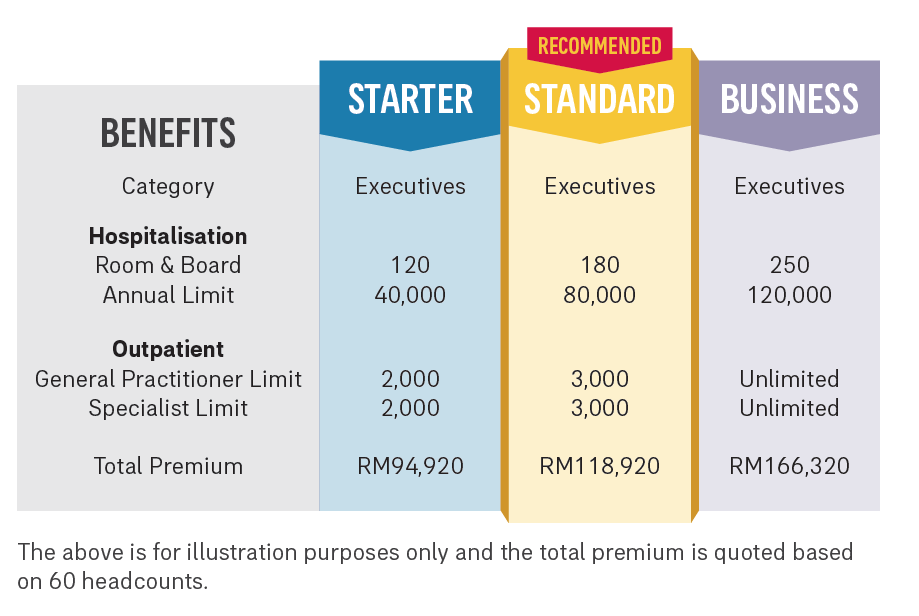

Optimize Your Employee Benefits with GHS Takaful Plans

Enhance your employee benefits package by selecting from the comprehensive GHS Takaful plans listed below. Tailor the medical benefits to suit your employees’ needs and their position in the organizational hierarchy. The premiums listed are for a year’s coverage.

GHS Takaful offers two primary health and medical coverage benefits:

- Hospitalization and Surgical Benefits:

Choose from various plans based on room types and annual caps or limits. These options provide comprehensive coverage for hospitalization and surgical treatments, ensuring your employees receive the best care when they need it most. - Outpatient Treatment Benefits:

Select plans with annual caps or limits on Specialist clinic visits for outpatient treatments. GP visits, on the other hand, come with unlimited coverage, offering flexibility and accessibility for your employees’ healthcare needs.

In addition to the core benefits, you have the flexibility to provide additional medical and health benefits to your employees and their families. Customize your coverage based on the following options:

- Employee only

- Employee and Spouse

- Employee and Children

- Employee and Family

Empower your workforce with top-notch healthcare solutions, supporting their well-being and productivity. By offering GHS Takaful plans as part of your employee benefits package, you demonstrate your commitment to caring for your employees and their loved ones’ health. Choose the right plans today and create a positive and rewarding work environment for your valuable team.

AIA Group Hospitalization and Surgical Package : Medical Benefits

As part of the GHS employee benefits package, AIA offers a robust and reliable medical takaful plan tailored to meet the health needs of your employees. With AIA’s Employee Medical Benefits Takaful Plan, your workforce can enjoy a range of health takaful benefits that promote their well-being and ensure peace of mind.

Key Benefits of AIA Group Hospitalization and Surgical Package : Medical Benefits Takaful Plan:

- eMedical Card and HR Portal for Easy Management:

AIA provides an eMedical Card and an HR portal, making it effortless for your organization to manage staff benefits efficiently. With the eMedical Card, employees can easily access cashless medical care for outpatient treatments, including consultations at both GP and Specialist clinics. - Letter of Guarantee for Smooth Hospital Admission:

Navigating hospital admissions becomes hassle-free with AIA’s Letter of Guarantee. Employees can avail themselves of easy admission and prompt treatment at hospitals, minimizing the stress and paperwork associated with medical emergencies. - Compassionate Allowance (Khairat Kematian) of RM 10,000:

AIA Takaful understands the importance of compassionate support during challenging times. With a Compassionate Allowance of RM 10,000 available across all plan options, your employees and their families can find comfort and financial assistance when they need it the most. - Malaysian Government Hospital Cash Allowance:

All plan options under the AIA Employee Medical Benefits Takaful Plan offer a Malaysian Government Hospital cash allowance of RM 200 per day, for up to 180 days. This additional benefit is subject to plan limits or caps, ensuring extended support during hospitalization. - Comprehensive Coverage for Chronic Conditions:

AIA’s medical Takaful plan covers chronic conditions such as cancer, diabetes, high blood pressure, and kidney dialysis. While coverage for these conditions is subject to waiting periods, it provides essential support for your employees’ long-term health needs. - Worldwide Coverage Equivalent to Treatment Costs in Malaysia:

The AIA Employee Medical Benefits Takaful Plan extends its coverage worldwide, ensuring that your employees can access medical treatment with coverage equivalent to treatment costs in Malaysia. This global coverage is particularly beneficial for employees who may need medical attention while traveling or working abroad.

What is Group Hospital and Surgical Benefit?

Group Hospital and Surgical Benefit is a comprehensive health Takaful plan designed for businesses and organizations to offer their employees. By opting for this plan, employees can access a range of medical benefits, including coverage for hospital stays and surgical procedures. This benefit is highly valued by employees as it ensures that their health needs are taken care of, allowing them to focus on their work with peace of mind.

How to Claim AIA Hospital Income?

Claiming hospital income with AIA is a straightforward process. In case of hospitalization, policyholders or their representatives should promptly notify AIA about the admission. After that, the necessary claim form, along with supporting documents, should be submitted within the stipulated time frame. Once the claim is approved, policyholders will receive the agreed-upon hospital income benefit for the duration of their hospital stay.

What Can You Claim Under AIA?

AIA Group Hospitalization and Surgical plans offer an extensive range of coverage, allowing policyholders to claim various medical expenses. These expenses may include room and board charges, surgical fees, in-hospital specialist consultations, diagnostic tests, and other related medical treatments. Additionally, AIA also provides coverage for pre-hospitalization and post-hospitalization expenses, ensuring comprehensive financial support throughout the entire treatment journey.

How to Sign Up for Group Hospitalization?

Signing up for AIA Group Hospitalization and Surgical plans for your organization is a wise investment in the well-being of your employees. To initiate the process, you can reach out to AIA’s dedicated agents or representatives, who will guide you through the available plan options and assist you in tailoring the coverage according to your organization’s needs. By offering comprehensive health coverage, you not only take care of your employees’ health but also boost morale and productivity within your workforce.

Which Trusted Agent Should You Contact?

Choosing the right agent is essential when it comes to selecting the most suitable Takaful plan. AIA works with a network of trusted agents who have the expertise to assess your specific requirements and recommend the best plan for you or your organization. When seeking guidance on AIA Group Hospitalization and Surgical plans, reach out to a licensed AIA agent who can provide personalized advice tailored to your unique needs.

You should engaged with Mohd Ibrahim Abu Bakar: The Specialist in AIA Takaful Group Hospitalization

Does AIA Cover Critical Illness?

While AIA Group Hospitalization and Surgical plans primarily focus on hospitalization and surgical coverage, AIA does offer separate critical illness Takaful plans. Critical illness coverage provides a lump-sum payout upon diagnosis of specific critical illnesses, helping policyholders manage their financial commitments during difficult times. For comprehensive protection, individuals can consider both AIA Group Hospitalization and Surgical plans and critical illness Takaful.

Panel Hospitals under AIA

AIA has a wide network of panel hospitals, providing policyholders with a broad selection of healthcare facilities to choose from. These panel hospitals have partnered with AIA to offer cashless admission and direct billing services, making the process of seeking medical treatment seamless and hassle-free for policyholders.

Minimum Staff Required to Sign Up for Group Hospitalization?

AIA’s Group Hospitalization and Surgical plans are designed to cater to businesses of various sizes. The minimum number of 11 staff required to sign up for group hospitalization may vary based on the specific plan and regulations in your region. To explore the available options and determine the minimum staff requirement for your organization, consult with an AIA agent who will guide you through the enrollment process.

Conclusion

AIA Group Hospitalization and Surgical plans provide individuals and organizations with comprehensive coverage and benefits, ensuring that their health needs are well taken care of. With coverage for surgical procedures, hospital stays, and a wide range of medical treatments, policyholders can face medical challenges with confidence, knowing that AIA has their back.

If you are considering AIA Group Hospitalization and Surgical plans for your organization, consult with a trusted AIA agent to explore the available options and find the most suitable plan that aligns with your needs and budget. By prioritizing the health and well-being of your employees, you not only foster a positive work environment but also strengthen your organization’s long-term success.

Frequently Asked Question

What is the coverage provided by AIA Takaful Group Hospitalization benefits?

AIA Takaful Group Hospitalization benefits provide comprehensive coverage for hospitalization expenses, including room charges, surgery fees, diagnostic tests, and more. This coverage extends to pre-existing conditions, ensuring holistic support for employees’ medical needs

Are AIA Takaful Group Hospitalization benefits cost-effective?

Yes, group plans often provide cost-effective options compared to individual health Takaful policies. By pooling resources together, employees can receive extensive coverage at affordable rates, benefiting both the organization and its workforce.

How do AIA Takaful Group Term benefits support employees?

AIA Takaful Group Term benefits offer life Takaful coverage, providing a lump sum payment to beneficiaries in the event of an employee’s untimely demise. This financial support can help cover funeral expenses, outstanding debts, mortgage payments, and support the well-being of the employee’s dependents.

Is the enrollment process for AIA Takaful Group Term benefits simple?

Yes, AIA Takaful Group Term benefits typically have simplified enrollment procedures, allowing employees to obtain coverage without extensive medical examinations or complex paperwork. This streamlines the process and ensures convenient access to this critical benefit.

How do AIA Takaful Group Hospitalization and AIA Takaful Group Term benefits contribute to employee well-being?

By providing comprehensive healthcare coverage and financial security, AIA Takaful Group Hospitalization and AIA Takaful Group Term benefits support employees’ overall well-being. These benefits reduce stress levels, promote productivity and engagement, and foster a positive work atmosphere.

What impact do these benefits have on employee retention and loyalty?

Offering AIA Takaful Group Hospitalization and AIA Takaful Group Term benefits demonstrates a commitment to employees’ long-term welfare. By supporting their families during challenging times and showcasing a dedication to their well-being, organizations can foster loyalty, increase employee retention, and attract top talent.

Mohd Ibrahim Abu Bakar: The Specialist in AIA Takaful Group Hospitalization

Meet Mohd Ibrahim Abu Bakar, a distinguished specialist in AIA Takaful Group Hospitalization, who has garnered recognition as one of the top providers of corporate solutions in the country. With a remarkable career spanning 15 years in the financial industry, Mohd Ibrahim’s expertise and dedication have earned him a prominent position in the Takaful sector.

As a specialist in AIA Takaful Group Hospitalization, Mohd Ibrahim possesses in-depth knowledge and a comprehensive understanding of the intricacies involved in providing effective Takaful solutions for corporate clients. His extensive experience allows him to offer tailored and robust coverage that meets the unique needs of organizations and their employees.

Mohd Ibrahim’s commitment to excellence is evident through his remarkable achievements, including being awarded as a top provider of corporate solutions in the country. This recognition highlights his exceptional abilities in delivering comprehensive Takaful packages that provide peace of mind and financial security to companies and their workforce.

Furthermore, Mohd Ibrahim’s exceptional professional achievements are exemplified by his membership in the prestigious Million Dollar Round Table (MDRT). This accolade is a testament to his outstanding performance and dedication to delivering exceptional financial services to his clients. As an MDRT member, Mohd Ibrahim consistently upholds the highest standards of professionalism and ethical conduct, ensuring that his clients receive the utmost care and attention.

With his wealth of knowledge and experience, Mohd Ibrahim Abu Bakar has become a trusted advisor for corporate clients seeking reliable and comprehensive Takaful solutions. His expertise in AIA Takaful Group Hospitalization, coupled with his commitment to providing exceptional service, has solidified his reputation as a leading specialist in the field.

Whether it’s navigating the complexities of group hospitalization coverage, customizing Takaful plans to meet specific organizational requirements, or ensuring seamless claims processes, Mohd Ibrahim Abu Bakar is dedicated to offering unparalleled expertise and support to his clients.

In conclusion, Mohd Ibrahim Abu Bakar’s exceptional track record, extensive experience, and recognition as a top provider of corporate solutions, combined with his membership in the esteemed Million Dollar Round Table, solidify his position as a specialist in AIA Takaful Group Hospitalization. His commitment to excellence and dedication to serving the needs of his clients make him a trusted advisor in the Takaful industry.

If you are interested in learning more about AIA Takaful Group Hospitalization or would like to explore your options, please provide your contact information. Our team will be happy to reach out to you and provide further assistance and information regarding the benefits and coverage of AIA Takaful Group Hospitalization.

Group Medical AIA Enquiries

.

Disclaimer

General Information Only

The information provided on this website represents our understanding and perspective on the subject matter as of the publication date. We aim for accuracy and relevance in our content, but we emphasize the importance of professional consultation for a complete and thorough understanding of the products and services discussed.

Consultation Recommended

We advise all clients and readers to seek advice from qualified professionals to gain in-depth knowledge about the topics covered on this site. Our content is designed for general informational purposes and should not replace personalized, professional advice.

No Responsibility for Misinterpretation

Efforts are made to ensure that the information presented is accurate and current. However, we cannot be held accountable for any misunderstandings, misinterpretations, or reliance on the content provided. Users should apply their judgment and discretion when utilizing the information for their specific requirements.

Content Subject to Change

Be aware that the content on this website may change without notice. We retain the discretion to update, alter, or eliminate content as needed.

External Links

This site may include links to third-party websites or resources for additional information. We do not guarantee the accuracy or endorse the content of these external sites and are not responsible for any information or services they provide.

Cookie Usage

Our website may use cookies to improve user experience and collect statistical data. By using this site, you consent to our use of cookies in accordance with our Privacy Policy.

Limitation of Liability

We shall not be liable for any direct, indirect, incidental, consequential, or other types of damages resulting from the use or inability to use the information on this website.

Agreement to Terms

By accessing this website, you acknowledge and agree to abide by these disclaimer terms. If you disagree with any part of this disclaimer, please do not use this site.

Update Notice

Last Updated: 22 July 2023

.

Sources

- 5 Reasons Why AIA Group Medical Takaful is Essential for Companies – (https://www.linkedin.com/pulse/5-reasons-why-aia-group-medical-takaful-essential-companies)

- AIA Takaful Group Hospitalization Term Benefits – (https://www.linkedin.com/pulse/aia-takaful-group-hospitalization-term-benefits-mig-advisory/)

- Benefits of AIA Takaful Group Hospitalization for Small and Medium Enterprises – (https://www.linkedin.com/pulse/benefits-aia-takaful-group-hospitalization-small-medium-bakar/)

- Comprehensive Guide to AIA Takaful Group Medical and Hospitalizations – (https://www.linkedin.com/pulse/comprehensive-guide-aia-takaful-group-medical-hospitalizations)

- 7 Reasons Why AIA Medical Card Comprehensive Health Takaful is the Best Medical Card in Malaysia 2023 – (https://perwarisanperniagaan.com/7-reasons-why-aia-medical-card-comprehensive-health-takaful-is-the-best-medical-card-in-malaysia-2023/)

- 8 Reasons Why You Need AIA Takaful Medical Card – (https://perwarisanperniagaan.com/8-reasons-why-you-need-aia-takaful-medical-card/)

- AIA GHS Takaful – (https://perwarisanperniagaan.com/aia-ghs-takaful/)

- AIA Group Medical Takaful – (https://perwarisanperniagaan.com/aia-group-medical-takaful/)

- AIA Medical Card Comprehensive Plan – (https://perwarisanperniagaan.com/aia-medical-card-comprehensive-plan/)

- AIA Takaful Corporate Solutions – (https://perwarisanperniagaan.com/aia-takaful-corporate-solutions/)

- AIA Takaful Group Hospitalization and AIA Takaful Group Term Benefits – (https://perwarisanperniagaan.com/aia-takaful-group-hospitalization-and-aia-takaful-group-term-benefits/)

- AIA Takaful Group Medical – (https://perwarisanperniagaan.com/aia-takaful-group-medical/)

- Benefits of AIA Takaful Group – (https://perwarisanperniagaan.com/benefits-of-aia-takaful-group/)

- Kebaikan Group Medical AIA – (https://perwarisanperniagaan.com/kebaikan-group-medical-aia/)

- The Benefits of AIA Takaful Group – (https://perwarisanperniagaan.com/the-benefits-of-aia-takaful-group/)

- Why You Need AIA Takaful Medical Card – (https://perwarisanperniagaan.com/why-you-need-aia-takaful-medical-card/)

- AIA Group Hospitalization and Surgical: Comprehensive Coverage and Benefits – (https://www.linkedin.com/pulse/aia-group-hospitalization-surgical-comprehensive-coverage)

- AIA Takaful Group Hospitalization Term Benefits – https://www.linkedin.com/pulse/aia-takaful-group-hospitalization-term-benefits-mig-advisory/

- Benefits of AIA Takaful Group Hospitalization for Small and Medium Enterprises – https://www.linkedin.com/pulse/benefits-aia-takaful-group-hospitalization-small-medium-bakar/

- AIA Employee Benefits – https://www.aia.com.my/en/our-products/employee-benefits.html

- 5 Reasons Why AIA Group Medical Takaful is Essential for Companies in Malaysia – https://www.linkedin.com/pulse/5-reasons-why-aia-group-medical-takaful-essential-companies-bakar/

- AIA CLAIM GUIDES – https://www.aia.com.my/en/help-support/claims-and-support/hospitalisation-corp.html

- AIA Total Corporate Solutions – https://www.aia.com.my/en/our-products/employee-benefits/total-corporate-solutions.html

- AIA Total SME Solution – https://www.aia.com.my/en/our-products/employee-benefits/total-sme-solutions.html

- AIA Mental Health Solution – https://www.aia.com.my/en/our-products/employee-benefits/mental-health-solutions.html

- The Benefits of AIA Takaful Group Hospitalization – https://www.majalah.com/?classified.the-benefits-of-aia-takaful-group-hospitalization-for-small-and-medium-enterprises-smes.GSC3JWXG9Z

- AIA Group Hospitalization and Surgical (GHS) Insurance for Companies and Organizations – https://perwarisanperniagaan.com/aia-group-hospitalization-and-surgical-2/

- Challenges Faced By High Net Worth Individuals in Managing Capital Statements and Tax Compliance – https://www.majalah.com/?classified.challenges-faced-by-high-net-worth-individuals-in-managing-capital-statements-and-tax.GTR3Y5LLN5

- Apa itu Penyata Modal atau Capital Statement – https://perwarisanperniagaan.com/penyata-modal-atau-capital-statement/

- Capital Statement From LHDN – https://perwarisanperniagaan.com/capital-statement-from-lhdn/

- High Net-Worth Individuals and Capital Statements for Tax in Malaysia – https://perwarisanperniagaan.com/capital-statement/

- Majalah.com – Capital Statement From Lhdn – https://www.majalah.com/?classified.capital-statement-from-lhdn.GTR3YF26BB

- Majalah.com – Apa Itu Penyata Modal atau Capital Statement – https://www.majalah.com/?classified.apa-itu-penyata-modal-atau-capital-statement.GTR3YJZWW5

- Medical Card AIA – https://perwarisanperniagaan.com/medical-card-aia/

- MMU Portal Berkaitan Perwarisan Perniagaan – https://alumni.mmu.edu.my/directory/pewarisan-perniagaan-business-succession-planning/

- 7 Powerful Steps to Claim HRD Corp-Claimable Training! – https://hrdtraining.mohdibrahim.com/hrd-corp-claimable-training/

- Step-by-Step Claim Submission Guide for Training Providers – https://hrdtraining.mohdibrahim.com/7-steps-to-claim-hrd-corp-claimable-training/

.